maryland digital advertising tax effective date

Maryland Senate Bill SB 787 became law 30 days after being presented to the governor who allowed the bill to pass without his signature. The Maryland legislature overrode Governor Larry Hogans veto of a new tax on digital advertising HB.

31 Social Media Marketing Tools You Need To Try In 2021 Shane Barker

732 establishes a new digital advertising gross revenue tax the first in any state.

. A bill that would amend the Maryland Digital Advertising Tax by. 732 imposes a tax on the annual gross revenues of. The Maryland digital advertising tax is already facing significant hurdles.

Digital advertising gross revenues tax Effective March 14 2021 and applicable to taxable years beginning after Dec. Definitional ambiguity suspect sourcing rules and unworkable geolocation requirements. The second bill HB.

787 delays Marylands digital advertising services tax until. The tax is imposed on entities with global annual gross revenues of at least 100 million that have annual gross revenues derived from digital advertising services in Maryland of at least 1 million in a calendar year. 732 on February 12 2021 making Maryland the first state in the country to adopt a.

Digital advertising gross revenue tax. The potential pitfalls of Marylands proposed digital advertising tax are numerous and the novelty of the proposal means that tax policy experts are still grappling with its implications. 1 This tax which is intended to be imposed.

Digital products including software-as-a-service are subject to Maryland sales tax as of March 14 2021. Marylands first-in-the-nation gross revenue tax on digital advertising took effect on March 14. March 01 2021 Updated April 29 2021 Update The Maryland legislature passed SB.

On November 24 2021 the Office of the Comptroller of Maryland MD Comp adopted final regulations outlining how the states new tax on gross revenues from digital advertising services DAT will. The Maryland Comptroller recently issued final regulations interpreting the Maryland digital advertising services tax. 31 2020 2 HB.

Even though the legislation says the tax is effective July 1 2020 under the Maryland Constitution vetoed legislation becomes effective the later of the effective date in the. This amendment would not delay the effective date of the tax it only changes the applicable tax year 2021 to 2022. Effective date in the previously vetoed.

Lawmakers approved House Bill 732 in March 2020. 12 when the Maryland legislature controlled by Democrats enacted what is effectively a gross receipts tax on digital advertising overriding a veto. The simmering debate boiled over on Feb.

Persons with global annual gross revenues equal to or greater than 100000000 must pay a tax on the portion of those revenues derived from digital advertising services in the state of Maryland. 787 which makes changes to the Digital Advertising Gross Revenue Tax including moving the. The tax on digital advertising services also takes effect March 14 and applies to all.

The tax applies to annual gross revenue derived from digital. Senate Bill 787 postpones the effective date of. The first-in-the-nation digital advertising tax is postponed for one year until 2022 while the state prepares regulations and guidance.

Being the first of its kind the unknowns and the uncertainty around its application has already caused Maryland to. The Maryland digital advertising. The Maryland Legislature has adopted the first digital advertising tax in the nation.

Maryland enacts tax on digital advertising services Tax Alert Overview On February 12 2021 the Maryland Senate following the House of Delegates. The Maryland gross revenues digital advertising tax became effective for tax years beginning after December 31 2021. 732 2020 the Maryland Senate on February 12 2021 passed the nations first state tax on the digital advertising revenues pulled in by large.

Its expected to generate 250 million in its first year. The effective date subsequently was delayed from 2021 until 2022. The first-in-the-nation digital advertising tax is.

Overriding the governors veto of HB. The proposed regulations raise at least three major issues. T 1 215 814 1743.

Learn about the recent updates surrounding the Maryland digital advertising and products tax issued by the States Comptrollers office - Baltimore CPA Firm.

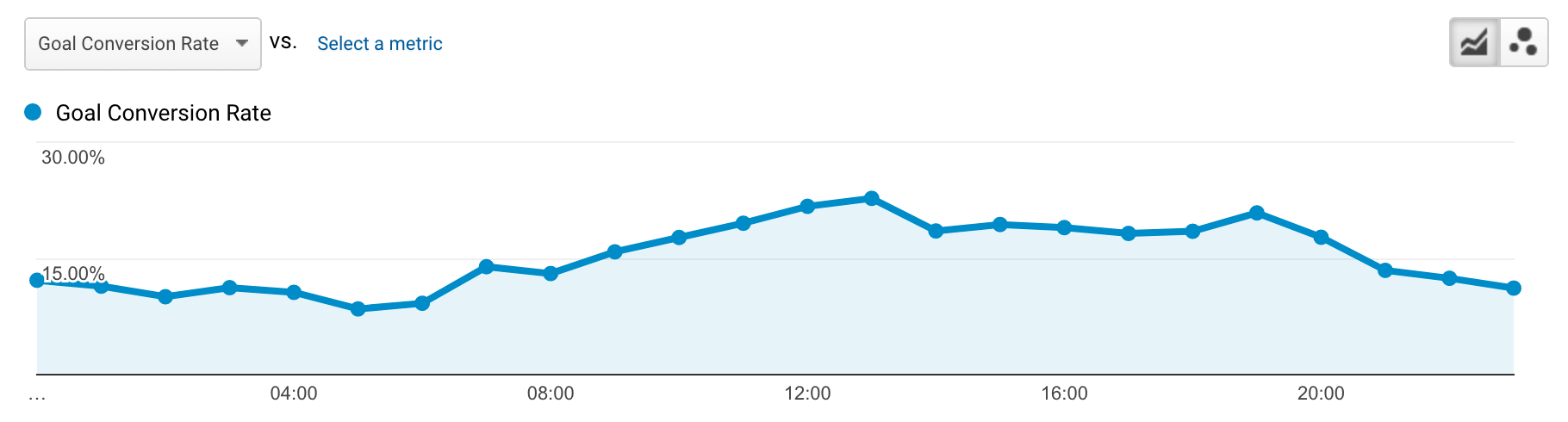

How To Optimize Your Google Ads Campaigns For Time Of Day

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

Q1 Payments For Maryland Digital Ad Tax Due April 15 Bdo

Just When You Thought You Were Out The Maryland Comptroller Drops Proposed Sourcing Reg For The Digital Ad Tax Eversheds Sutherland Us Llp Jdsupra

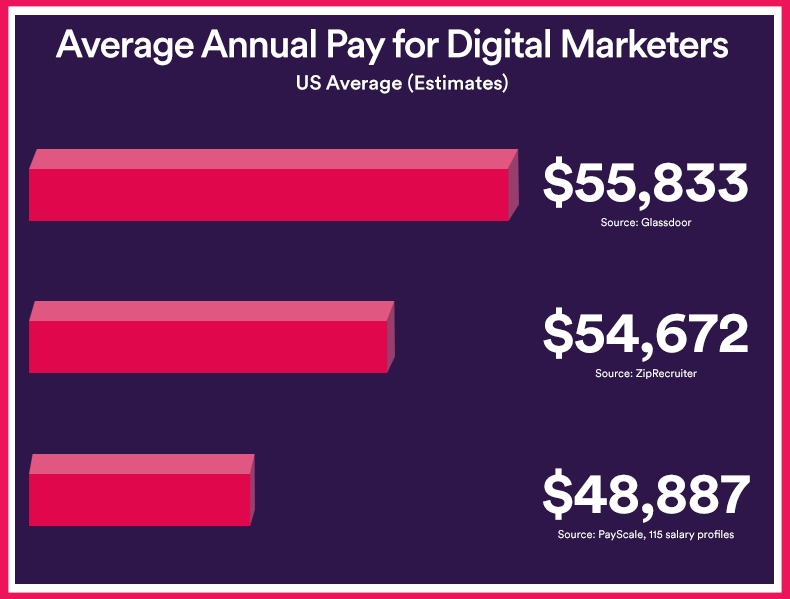

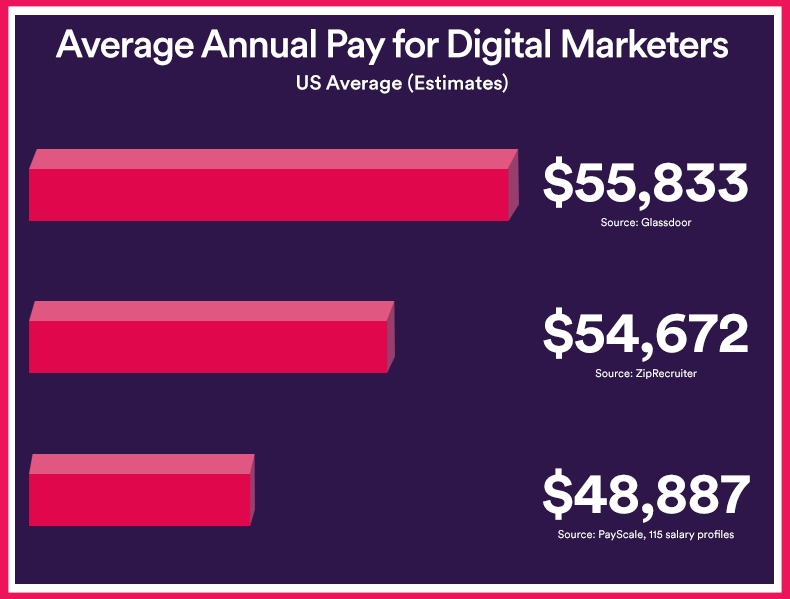

How Much Do Digital Marketers Make State Wise Salaries In Usa 2022

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

Md Digital Advertising Tax Bill

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

Maryland Amends Its Digital Advertising Gross Revenues Tax Creating Additional Constitutional Infirmities Salt Savvy

Just When You Thought You Were Out The Maryland Comptroller Drops Proposed Sourcing Reg For The Digital Ad Tax Eversheds Sutherland Us Llp Jdsupra

Google Says It Won T Track You Directly In The Future As It Phases Out Cookies

Maryland Delays Digital Advertising Services Tax Bdo

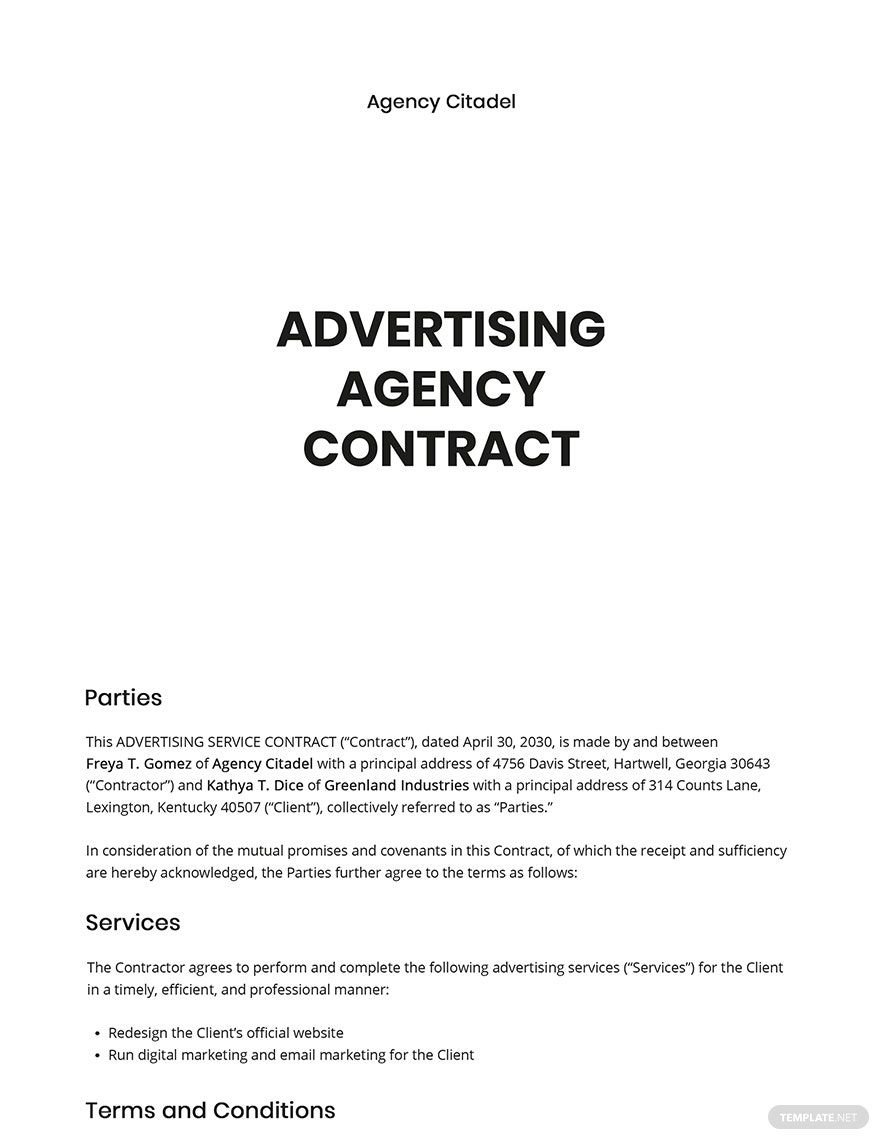

Contract Templates 462 Docs Free Downloads Template Net

Top Digital Marketing Agencies 2022 Reviews

Maryland Tax On Digital Advertising Services Enacted Kpmg United States

New Maryland Sales Taxes On Digital Products Computer Software E Books E Music Some Webinars And More Are You Up To Date Maryland Association Of Cpas Macpa

Just When You Thought You Were Out The Maryland Comptroller Drops Proposed Sourcing Reg For The Digital Ad Tax Eversheds Sutherland Us Llp Jdsupra

How Much Do Digital Marketers Make State Wise Salaries In Usa 2022

![]()

How To Get Certified By Google For Digital Marketing Navneet Vishwas